Financial Considerations for Private Practices during the Current Health Crisis

The Panel of National Pathology Leaders is a national “think tank” dedicated to seeking practical solutions to challenges faced by Pathology practices.

In our previous quarterly newsletter (published on April 3, 2020), PNPL’s Panelists assembled several items for consideration to help Pathology practices conserve cash and offset a drop in volume and related collections.

A variety of new programs and guidelines have been issued. This is a summary of the newest information.

Paycheck Protection Program Flexibility Act (PPPFA)

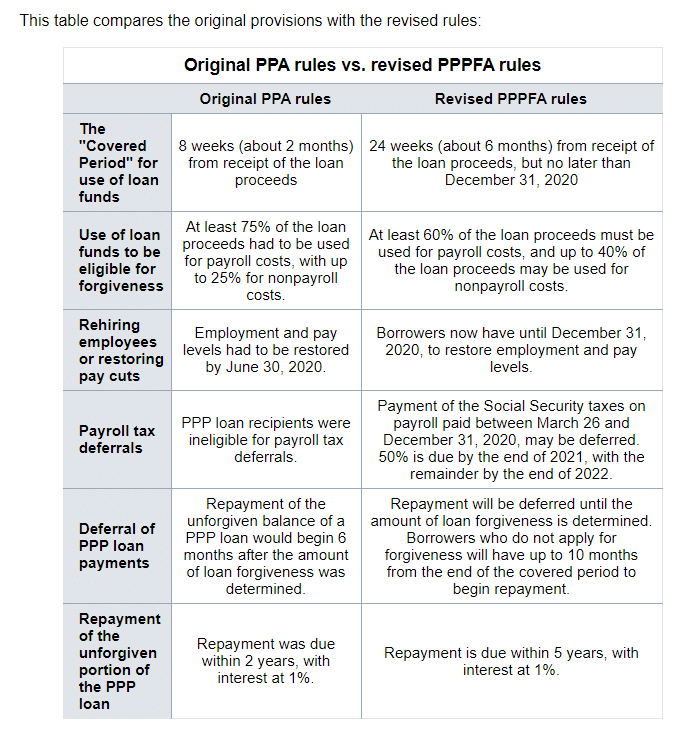

On June 3rd, the U.S. Congress passed the Paycheck Protection Program Flexibility Act of 2020 (PPPFA), which modifies the Paycheck Protection Program (PPP) established through the Coronavirus Aid, Relief, and Security (CARES) Act.

This latest legislation changes the requirements that will lead to full forgiveness for most loans.

The chart below was excerpted from an article by Rebecca Farrington from Healthcare Administrative Partners on LabPulse.com.

Paycheck Protection Program Forgiveness (PPP)

- All practices that received a PPP loan will need to apply eligible payroll and expenses for full forgiveness

-

- Salaries limited to $100,000 per employee

- Compensation will be forgiven up to:

-

- $15,385 = $100,000 per employee x 8 weeks

- $46,152 = $100,000 per employee x 24 weeks

- $20,833 = the amount paid to owners

-

- Inclusive of health for S corp owners

- Inclusive of health and retirement for general partners

-

-

- Benefits – Health/Dental/Vision and any Health Savings Account (HSA) plans (excludes Life and Disability)

- Retirement plan

-

- Contributions up to the IRS max of $285,000

-

- Rent, including any payments made to a hospital for technical services or for space to provide referred activity. This also includes rent adjustments such as property taxes and operating costs if the lease is net/net.

- Utilities, including phone, gas, electric, water, cable/internet

- Lease payments for equipment and furniture, including postage meter, copier, software

-

- Calculate the lowest FTE baseline:

-

- As 02/15/19 – 06/30/19 or 01/01/20 – 2/29/20, and compare to the forgiveness period.

-

- Prepare the forgiveness application (SBA Form 3508 or 3508 EZ).

- SBA will publish data for PPP loans greater than $150,000.

Other Government Programs

- Medicare Grant

-

- CDC issued a report showing payments for each provider.

- The amount was based on 6.2% of Medicare payments for 2019 services.

-

- Provider Relief Fund (2% of 2019 or 2018 income)

-

- Based on submitting loss of income for March and April 2020

- Submitting tax return

- Reduced by the Medicare Grant previously received

-

- Main Street Loans

-

- The Main Street Lending Program is a new offering created by the Federal Reserve to help businesses during the ongoing COVID-19 crisis and accompanying economic downturn.

- It offers an alternative to the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL) program and the Express Bridge Loan program.

- Companies that have already applied to the PPP are also eligible for loans through the Main Street Lending Program.

- Unlike other coronavirus relief efforts for small businesses, these programs are not connected to the Small Business Administration.

-

Marketing

- Add an announcement to your website detailing back-to-work plans and other updates since the crisis began.

- If you are on social media, post updates corresponding with the ones on your website.

DISCLAIMER: Please check with your accountant or attorney before implementing any of the actions above. This information is provided as suggestions for consideration and is thought to be accurate as of the date of the publication. All action taken, or not taken, is the responsibility of the reader.